Businesses lose customers regularly. Some, through bad customer support, bad products, or bad service. But there's nothing worse than losing customers due to involuntary churn. It's frustrating too, not only for the business owners but more importantly for the customers. Imagine them wanting more gravy but the gravy boat is locked and they're left salivating for your product.

But before we deep dive into saving your customers from involuntary churn on stripe recurring payments, what exactly is Involuntary Churn? Why do so many businesses shudder at the mere mention of it?

Involuntary Churn is that moment when your loyal customers try to pay for your product or service but the payment is blocked for some reason which results in a loss in customers and revenue. And the more loyal your customers are, the more likely that payment failure will happen.

Why does this happen?

It's simple. According to Stripe, payments can fail for a variety of reasons. It can be blocked or declined by card issuers to protect their clients. Sometimes, the tech also fails such as invalid API calls. Your customers' payment information (i.e. credit cards) can become outdated over time. And, this payment failure risk becomes greater as time passes — so, in essence, the more loyal the customer, the more likely it is that their subscription will be accidentally canceled. Definitely a perfect recipe for a frustrating experience.

To recap, involuntary churn happens when your subscribed customer tries to pay for using your service and their payment doesn’t successfully go through which consequently leads to subscription cancellation. This kind of churn is labeled “involuntary” because it doesn't result from the customer's active will and conscious choice.

SaaS startups have been focusing on automation to solve involuntary and voluntary churn. Gravy has applied the human touch to reduce subscription cancellations in a way that is more effective than dunning softwares.

Gravy’s people-powered payment recovery increases customer retention and puts more recurring revenue into your bottom line.

What Causes Stripe Payment Failures

If you have Stripe managing your payment solutions, you have probably experienced payment failures. Or perhaps that is the reason why you arrived at this article. So let us figure out why this happens. As we have mentioned earlier, there are 3-5 major reasons why Stripe is unable to process your customers' payments.

Expired Credit Card

Sometimes, it begins with something as simple as an expired credit card. Your credit card expires and you need to renew it on your account. But you have to log in and update it on the app/service/dashboard and it's just too much bother. This happens to your customers too. Fortunately, this is a common problem and probably the easiest to solve.

Unupdated Billing Address

Clients move. So they have to update their addresses with their card issuer. Unfortunately, the customer also neglects to update their address on your records. So the bank automatically detects this and suspects a problem. As a result, the card is declined and results in, you guessed it, involuntary churn and canceled subscriptions.

Maxed out Card

As occasionally happens even to the best of us, our card reaches its maximum capability. When a card is maxed out, this sends alarm bells to Stripe, and payment is blocked until customers update their data. This happens often and it's one of the top reasons for involuntary churn.

The card is reported stolen

Alas, it happens that some cards are reported stolen. Some people also lose their cards and report them as stolen. Whether true or just a misunderstanding, this can have a major repercussion on your churn records if the customer doesn't update their credit card information on their accounts as well.

All others

Under the All Others Heading are the sort of mysterious things that keep happening that you cant find no rhyme or reason for. It's probably a tech thing, like a bad API that only your technical support and Stripes technical support putting their heads together can solve. If you're the type to do an extensive investigation, you're in for some treat! We put together an extensive how-to on finding out and measuring your Stripe failed payments below.

How To Find and Measure Stripe Failed Payments

In the world of payment merchants, Stripe stands tall over the rest of the pack. But like all payment merchants, finding and analyzing your failed payments isn't the most straightforward task.

This handy how-to guide walks you through step-by-step how to do this task easily and accurately.

Stripe is the true king of payment merchant software.

Simple, easy, and incredibly flexible.

Except when it comes to… failed payment reporting.

Okay, really, it’s probably one of the easier payment merchants to pull failed payments from.

But, that doesn’t mean it’s not without some teeth pulling and nifty spreadsheet work.

Sure, Stripe can filter your failed pays and give you visibility within the console. But, without looking at it in a Google Sheet, you have no way of knowing what you’re actually losing every month.

No worries, though! Because this is exactly what we’re here for.

Below we’ll outline in super easy steps how to pull failed payments in Stripe and get a true read on your failed pays every month.

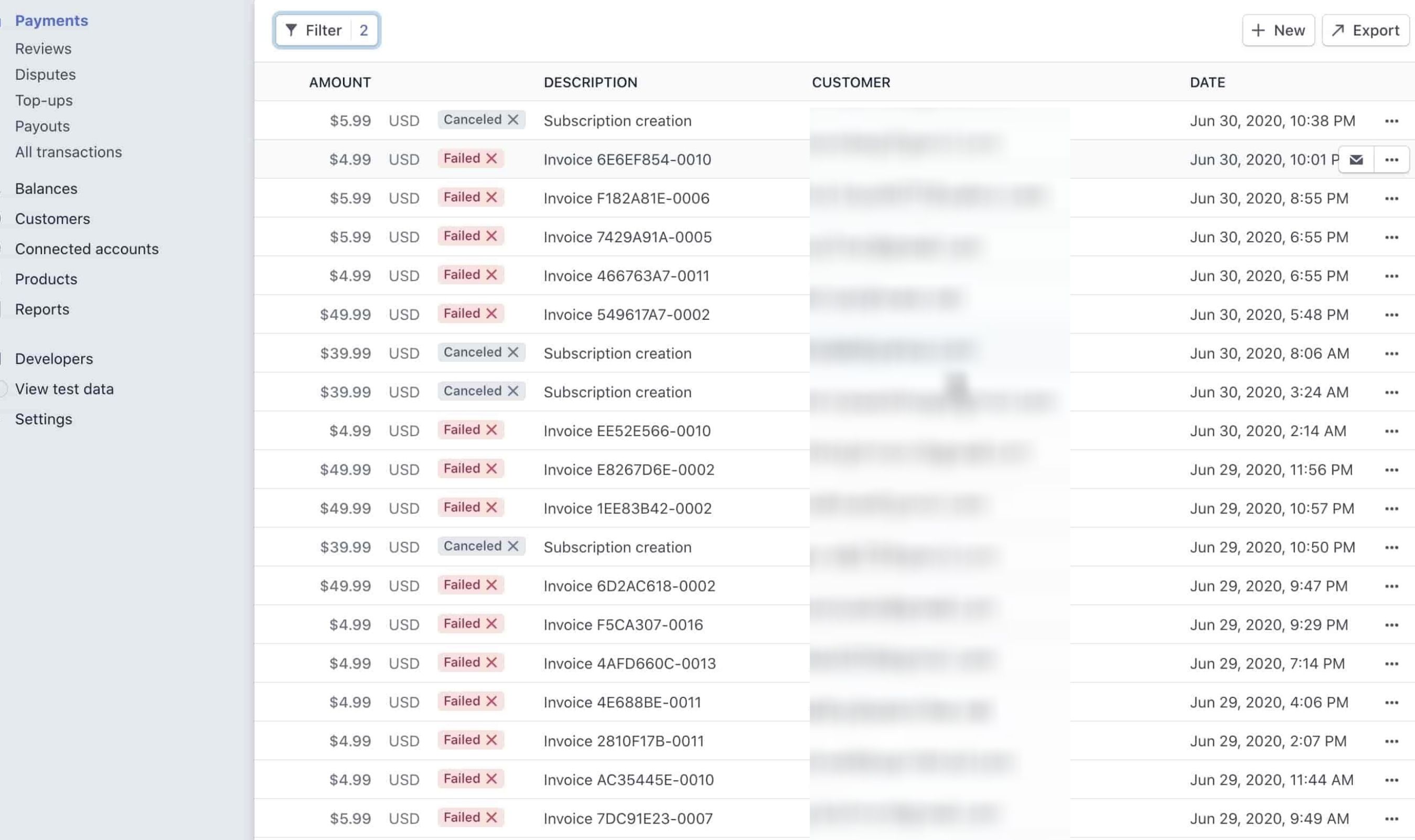

Here’s the layout you see for your Payments tab within your Stripe dashboard. Look at all that green 😎.

But underneath that is where all your underlying issues may be lurking.

So, let’s pull out that failed payment data.

To start, you hit the Filters tab and choose your date range. Use the between function and pick the range you want.

We recommended picking a solid month. So if the above image says July, we would go back to June and choose the entire month.

You can also pull by the week or even daily if you’re inclined.

Next, switch off the default “Succeeded” check box and scroll down to choose “Failed.” Stripe has it towards the bottom, so it can be easy to miss:

After you do that, hit “Done” and your failed payment list will load!

One thing to note regarding this filter: You will notice there are two different categorizations Stripe uses for Failed payments.

One in “Canceled” and the other is “Failed.”

These are two different distinctions that Stripe is making for you:

- Canceled - Notes a Failed Payment where a customer creates a subscription then cancels before their next charge. Stripe will not initiate a retry in this instance or send a dunning email. We wrote a blog post on everything that you need to know about dunning solutions.

- Failed - Denotes a failed credit or debit transaction, where the bank would not accept payment. Payment fails to happen for all kinds of reasons.

2. Export Failed Payments to CSV

While Stripe gives you the failed payment report within the dashboard, it’s not helpful in sorting or deduplicating those failed payments.

In order to get a full picture, you’ll need to export to CSV.

Exporting in Stripe is pretty simple - although, there are a couple of things you should make sure of.

The first thing you should do is choose the “All Columns Option” for the export. This is going to far more information for you to sort through to come up with insights as to why customers are failing in payments - and perhaps offer some ideas for retention practices.

Some of the additional columns of information you get from choosing all include:

- Card Brand

- Card Exp Month

- Card Exp Year

- Card Funding

- Dispute Reason

You can use all of these in reporting to countermeasure against involuntary churn and increase your MRR.

.jpeg)

3. Sort & Deduplicate Payment Fails

Once you finish exporting and get your data into a sheet, the next step is to sort and deduplicate the data.

When Stripe exports failed payment Data, it exports ALL the payment data. This includes every retry and failed attempt. So often, the exported spreadsheet isn’t an accurate reflection of your failed payment reality.

Take this sheet for example, which has 1,282 rows of data:

While they may seem like a LOT to sort over, a big reason why is because most of it is Stripe trying to get the same person’s payment through over and over again.

So how do you clean this sheet up?

You deduplicate!

Google Sheets has a nifty add-on tool called “Remove Duplicates” that will allow you to get rid of those repeat email addresses.

Here’s how to use it:

- Go to “Add-ons” → “Remove Duplicates” → “Find duplicate or unique rows”

- Choose the entire spreadsheet cell range and click “Next”

- Choose “Find Duplicates”, click “Next”

- Uncheck all the columns, then choose “Amount” and “Customer Email”, and click “Next”

- Choose the desired action with the found values, then click “Next”

Note: you have two choices here and either will work. You can either color code the duplicate cell or you can have Google Sheets automatically delete the chosen duplicate rows.

For this exercise, we chose to color code the duplicate rows, which will add a couple more steps to the process:

- Add a Filter to the Top Row

- Go to “Filter by color” → “Fill Color” → “yellow” (or whichever color you choose)

After that, check the rows as you see fit, then select and delete all the duplicates.

4. Find Failed Payments

After you get your spreadsheeting deduplicated, now you can finally see what your failed payment data truly looks like.

Add a blank row at the top of your sheet, then insert the SUM function. Google’s smart enough to automatically pick the cell range, and you can see where you’re at for failed payments:

As you can see on the sheets, this example has more than $23,000 in failed payments for the month of June.

Yikes.

So what’s the total count of failed payments? Use the COUNT function to count up any total cell range.

In this example, this company has 507 unique failed payments for the month of June.

5. Next Steps

Now that you’ve figured out how much revenue you’re losing to failed payments, what are your next steps?

First, you can contact us by hitting the Chat feature on the bottom right.

We’d be thrilled to discuss your failed payment challenges and how we can uniquely solve them in ways traditional dunning processes are unable to.

In the absence of that, here are other ways to go about assessing and dealing with involuntary churn:

- Activate Your Dunning Software. Yes, dunning is only going to recover between 10 - 15% of your failed payments, but even that is far better than doing nothing.

- Execute a Standard Operating Procedure. In reality, this is an extremely complex operation to do effectively, requiring a lot of tedious data mining work plus an effective communication and iteration process. There are some companies with the size and human resources to do this, however. For others, it’s simply not that cost-effective.

- Utilize Collections. This should only be used if your goal is to simply try and recoup payment - and only if you have legal grounds to do so. You can set your payment merchant and subscription CRM to continue delivering content/services even if the customer is delinquent, and use this method to collect payment. However, you’re nearly certain to lose this customer off a poor brand experience.

- Failed Payment Recovery Services. This is where Gravy comes in. Our service is predicated on being far more humanizing than a dunning software and way more compassionate than collections. This leads to a 50% or better-failed payment recovery rate with Customers that keep paying.

If you are wondering how to calculate churn rate and customer retention, then take a look at our blog post that lists the steps that you need to take.

How Gravy Works With Stripe Recurring Payments

Below are the steps that show how Gravy recovers failed payments and boost customer retention.

1. Simple Access Into Your Stripe Payment Processor

• We easily access your Stripe Payment Gateway directly

• Gravy’s Implementation Team deep dives into your failed payment data on Stripe Payments

• Our Revenue Management Team works side by side with your Company to customize the Process unique to you

• We use our tried and true failed payment recovery method to start saving your subscribers and adding real money to your bottom line

2. White Label Failed Payment Recovery

• Gravy’s customer retention specialists work as an extension of your team

• Your brand, your logo, your cadence, and your voice is represented in every failed payment recovery attempt we make

• Your customers need to know it’s you reaching out to them. We make sure you never feel like your company isn’t represented

• 60 days of methodically tested and effective failed payment recovery that nets you results

3. Simple Access Into Your Stripe Payment Processor

•We easily access your Stripe Payment Gateway directly

•Gravy’s Implementation Team deep dives into your failed payment data on Stripe Payments

• Our Revenue Management Team works side by side with your Company to customize the Process unique to you

• We use our tried and true failed payment recovery method to start saving your Subscribers and adding real money to your bottom line

Gravy Versus Stripe Payment Recovery Dunning Softwares

Powered by people, Gravy’s human-based approach saves up to 3x more Customers and Revenue than your current Stripe Payment dunning software.

Don't get us wrong. We love (most) dunning software. They do a great job of automatically reaching out to lost customers. They're cheaper too. But we know what happens there. Because it's automated, things fell through the cracks. Emails get rejected. They fall on the Spam box. And let's admit it, even if it does get into the right inbox, we are getting better at ignoring automated email.

And that's where Gravy comes in. As a human solution, we can step in and deal with whatever situation your customers are dealing with. We are communicating and conversing with your customers on your behalf and that makes them feel valued and appreciated.

While the average dunning software recovers about 15% of your failed payments, Gravy’s average is 50%, with a sizable number of our client's savings >70% of their failed payments through our human-led recovery outreach. It's a powerful thing and we as a company are pretty proud of this.

Watch this video on why dunning softwares do not provide a great experience for customers compared to the human-approach.

Increase Your Stripe monthly recurring revenue with this list of proven ways to boost customer retention.

Our Clients Say Gravy Saves Them Thousands In Failed Payment Recovery

Your customers crave a human experience at every touchpoint. We make sure they get one - and it’s from your brand.

Amy Porterfield

CEO, Amy Porterfield, Inc.

“Gravy took my recovery rate from 33% to 79%."

Nicole Walters

Founder & CEO, NapNic LLC

“Thanks to them, my failed payment recovery rate has grown to 68%.”

Start Recovering

Failed Payments Today.

.jpg)